When you're considering starting your own financial consulting business, it is important to choose the right type of business structure. In general, you can operate as a sole proprietor, a partnership, a limited liability company or even a corporation. The legal structure you choose will help protect you from personal and potential lawsuits. In most cases, you can form an LLC for a minimal fee by using a Best LLC Service.

Cost of financial consultation

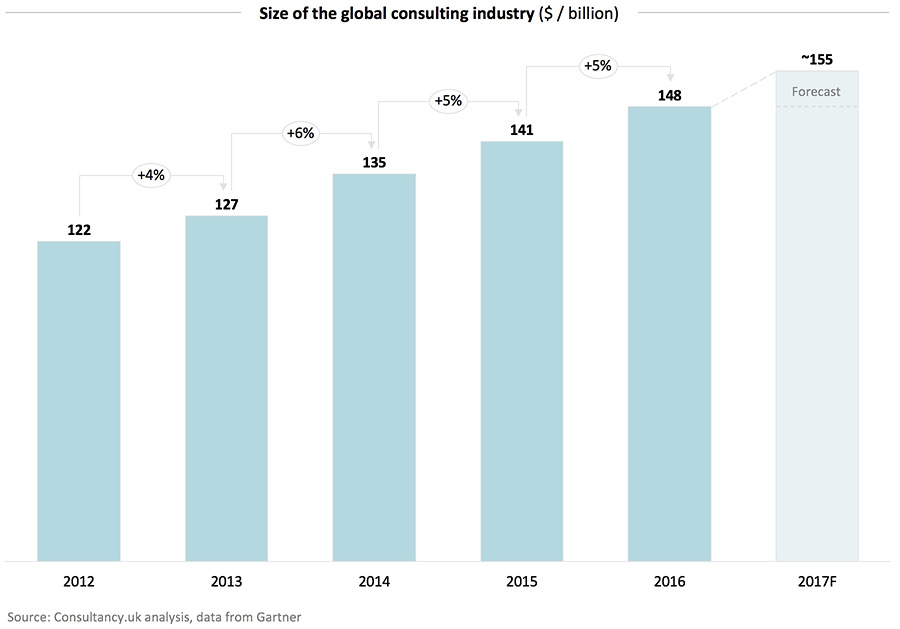

Global Financial Consulting is expected to grow at a CAGR X.X% by 2026. The report examines the overall market, including growth factors, competitive landscape and consumption patterns. It also provides information about the most prominent providers. The report also addresses the macroeconomic climate and the COVID-19 outbreak, which are expected to have a negative impact on the market. The report also covers the market for financial consulting by type, application, region, and geography.

While some planners charge an hourly fee for their services, others bill clients per project. A few fee structures allow hourly financial advisors to charge $2,500 annually for planning services. They can also offer full-service portfolio management, and some bill for only 1:1 time. Additional services like investment advice can be provided by hourly-rate financial advisors. You should know these fees before you hire a professional financial planner.

Working with clients to develop individual financial plans

Financial planning is the art of guiding one's money to achieve a desired outcome. Financial advisors help clients set and achieve goals by assessing their current financial situation, identifying their objectives, developing an individualized plan, and monitoring progress. A financial planning firm, like K.W. Gutshall & Associates can help clients reach their financial goals by creating individualized financial plans. They work closely alongside clients to ensure that their financial plans are on target and make the most of available resource.

Be mindful of the unique perspectives of clients when working with them. The plan may be affected by cultural norms or expectations. A plan's past experience can also have an influence on it. Individualized financial planning can be trusted more by clients. As you develop your plan, make sure to hear what your clients think and value. This will help your clients live more comfortably in their financial lives.

Pay scale for financial consultants

The pay scale for financial consultants varies widely. Entry-level positions can earn up $26,000 annually. Financial Consultants in the middle 57% earn between $106,689 to $268,807 annually. The highest earning earners are those who earn over $51,500 per annum. These figures depend on many factors including where they live and how long they have been working. Below are the common salaries of Financial Consultants working in different fields.

In the calculation of Solutions pay, assets that leave the Financial Consultant's office are taken into account. These assets are then netted against the assets they brought into their practice. The Consultant's hourly rate is then calculated. The rate can vary from 4.4 to 14 basis point per $100,000 client loan balance. Accordingly, an average Financial Consultant earns $44 for every $100,000 in loan balance. The Financial Consultant can make up to $60,000 per calendar year if the investment account balance is $1,000,000

Ethics of financial consultants

Financial advisers face many ethical problems, including conflict of interests and duty. Traditional ethics recognize two main ways conflict of interest can occur: when an adviser places his or her own interests before those of a client. However, these issues are rarely mutually beneficial. If advisers were ethical, they would place the clients' best interests before their own. Although it's okay to sacrifice one's interests in certain circumstances, this is not a good practice for advisers. Instead, advisers should work to promote mutuality and equality as the foundation for their business.

This study examines how financial advisers' ethical decision-making is reflected in their practices. The AFS Code of Ethics outlines 12 ethical principles that financial advisors must follow in their practice. The financial adviser must be able to determine who is acting in the client’s best interest at all costs. As this may impact the recommendation of investment, they must also consider the client’s unique financial situation. This study also looks at ethical issues involved in high-risk investments products and their sale.

FAQ

Is it possible to run a consultancy business from home?

Absolutely! In fact, many consultants already do exactly this.

Most freelancers work remotely using tools like Skype, Slack, Trello, Basecamp, and Dropbox. They often create their own office space so they don't miss out on company perks.

Some freelancers prefer working in cafes and libraries over traditional offices.

Some choose to work remotely because they are surrounded by their family.

Of course, working from home has its pros and cons. It's worth looking into if your job is fulfilling.

What contracts are available for consultants?

Standard employment agreements are signed by most consultants when they are hired. These agreements define the terms of the agreement, including how long the consultant is expected to work for the client as well as what he/she should be paid.

Contracts specify the area of expertise that the consultant will specialize in and the amount they will be paid. A contract may state that the consultant will deliver training sessions or workshops, webinars, seminars and other services.

Sometimes, the consultant simply agrees that a specific task will be completed within a set time frame.

In addition to standard employment agreements, many consultants also sign independent contractor agreements. These agreements allow consultants to work independently while still receiving payment.

What is a consultant and what are their responsibilities?

A consultant is someone who offers services to others. It's not a job title. A consultant is a role that helps others achieve their goals. By helping people understand their options and helping to make the right decisions, you do this.

Consultants are experts in finding solutions to the problems and challenges that arise while working on projects. They offer guidance and advice about how to implement such solutions.

Any questions you have about business, technology and finance, leadership or strategy, human resource management, customer service, customer service, or any other topic, a consultant can answer them.

Do I require legal advice?

Yes! Yes. Consultants can often create contracts with clients, without seeking legal advice. This can lead into problems down-the-road. For example, what happens to the contract if the client terminates it before the consultant has completed? What happens if the contract stipulates that the consultant must meet certain deadlines?

To avoid any potential problems, it is best to consult a lawyer.

How much do consultants make?

Some consultants make over $100k per year. However, most consultants only make $25-$50k. A consultant's average salary is $39,000 This applies to both hourly and salaried consultants.

Salary depends on the experience of the consultant, their location, industry, type and length of the contract (contractor or employee), as well as whether they have their own office or work remotely.

Statistics

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- So, if you help your clients increase their sales by 33%, then use a word like “revolution” instead of “increase.” (consultingsuccess.com)

External Links

How To

What should I do to get started with a consulting business?

Starting a Consulting Company is a great way to make money online from home. It doesn't require any prior business experience nor capital. It is possible to create a website to launch your consulting business. To promote your services, you will need to create a website.

These tools allow you to make a marketing program that includes the following:

-

Blog Content Creation

-

Contacts are essential for building relationships

-

Generating Leads (lead generation forms).

-

Selling products on e-Commerce websites

Once you've created your marketing strategy, the next step is to find clients who are willing to pay you for your services. Some prefer to connect with people through networking events. Others prefer to use online resources like Craigslist and Kijiji. It's up to you to make the decision.

Once you have found clients, you should discuss terms and payment options. This could include hourly fees, retainer agreements, flat fee contracts, etc. Before you accept a client, you need to know what you expect so that you can communicate clearly all through the process.

An hourly contract is the most popular type of contract for consulting services. This agreement allows you to agree to provide services at a fixed price each week or month. You might be able, depending on which service you offer, to negotiate a discount. When you sign a contract, make sure you fully understand it.

Next, create invoices and then send them to clients. Invoicing can be a complicated task until you actually attempt it. There are many ways to invoice clients. It all depends on your preference. For example, some people prefer to have their invoices emailed directly to their clients, while others print hard copies and mail them. No matter what you do, make sure it works!

After you've created your invoices, you can collect payments. PayPal is preferred by most because it is easy-to-use and offers multiple payment options. There are many other payment options, such as Square Cash, Square Cash and Google Wallet.

Once you are ready to start collecting payments, it is time to open bank accounts. You can keep separate checking and savings accounts to track income as well as expenses. When paying bills, it is also beneficial to set up automatic transfer into your bank account.

Although it can seem daunting when you first start a business as a consultant, once you get the hang of it, it will become second nature. Our blog post contains more information on how to start a consulting business.

The best way to make extra cash is to start a consulting business. Many consultants work remotely. They don't have any need to deal with office politics, long hours or office politics. Remote employees have more flexibility because they are not bound by regular work hours.